Hudbay Minerals Inc. stock continued its precipitous decline closing Wednesday at a six-year low of $4.13 a share on the New York Stock Exchange as fears of a slowing world economy continue to depress commodity prices.

Hudbay is proposing to construct the Rosemont Copper Mine in the Santa Rita Mountains on the Coronado National Forest southeast of Tucson.

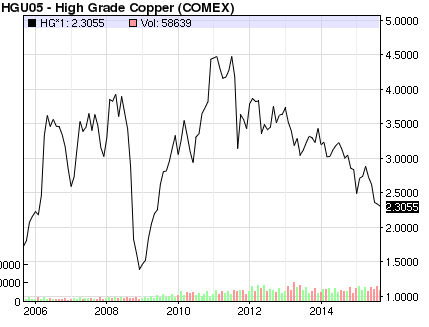

The company’s stock has plummeted since closing at $10.28 on April 27 as copper prices continue to decline on weakening demand from China. Copper closed at $2.30 on the COMEX Wednesday, down from $2.90 in early May.

Copper has historically been a volatile commodity with wide price swings that closely track worldwide economic trends.

Hudbay’s stock price tends to go up and down with the price of copper.

Hudbay’s stock price tends to go up and down with the price of copper.

The Arizona Daily Star on Thursday published a brief synopsis of the impact of copper prices on the state’s economy from 2001 through 2015.

The Arizona Daily Star on Thursday published a brief synopsis of the impact of copper prices on the state’s economy from 2001 through 2015.

“The sometimes dizzying bust-boom-slump-boom history of copper is especially well-known in Arizona, a region that — combined with New Mexico and Sonora — is the world’s second-richest source of the metal after Chile,” the Daily Star reports.

In October 2001, copper was trading at 63 cents per pound. The price soared to nearly $4.50 a pound by June 2011, before beginning a steady decline to $2.30 Wednesday. Slowing growth in China, which consumes about 45 percent of the world’s copper, is widely cited as the primary cause for the steady drop in copper prices.

Hudbay Minerals CEO David Garofalo stated at the company’s annual meeting last May that the copper price would have to return to $3.50 a pound before Hudbay would bring on additional copper production, raising questions over when the Rosemont project would be viable.

The company, however, told the Daily Star earlier this month that it intends to move forward with the Rosemont project because of the cyclical nature of copper prices.

Hudbay still needs several key permits before construction could begin, including a Section 404 Clean Water Act Permit from the U.S. Army Corps of Engineers and a Air Quality Control Permit from the state of Arizona.

THE MINING BUSINESS IS HIGH RISK AT BEST . WHEN TIMES ARE GOOD , IT IS VERY GOOD BUT WHEN TIMES ARE BAD , IT CAN BE VERY BAD . HUDBAY HAS SURVIVED THROUGH 90+ TEARS OF BOOM AND BUST . THIS INDICATES THAT THEY DO GET IT RIGHT MOST OF THE TIME AND HAVE BEEN ABLE TO SURVIVE . THE US IS PROBABLY A MORE FAVOURABLE MINING JURISDICTION TO SURVIVE IN THAN CANADA . THE OLD AND ANTIQUATED US MINING ACT GIVES MINING COMPANIES FINANCIAL ADVANTAGES , IE , NO ROYALTIES TO PAY , UNLIKE MANY COUNTRIES .

RIGHT NOW , TIME IS IN HUDBAY’S FAVOUR . THE LONGER IT TAKES THE FOREST SERVICE TO ISSUE THE REMAINING PERMITS , THE LONGER IT TAKES FOR HUDBAY TO MOVE AHEAD . THEY REALLY DO NOT WANT TO MOVE AHEAD AT THIS TIME BUT THEY PUT ON A BRAVE FACE FOR THE SAKE OF THEIR SHAREHOLDERS .

HUDBAY WILL NOT ABANDON THEIR ROSEMONT PROJECT UNLESS THE ECONOMICS OF BRINGING IT INTO PRODUCTION ARE PROVEN TO BE UNTENABLE . THE RESULTS OF THEIR RECENT DRILLING PROGRAM HAVE NOT BEEN MADE PUBLIC . THERE APPEARS TO BE MORE COMPLEXITIES TO THE DEPOSIT THAN WERE REPORTED BY AUGUSTA . AN EXHAUSTIVE METALLURGICAL STUDY REQUIRES A REPRESENTATIVE BULK SAMPLE NOT SIMPLY THE COMPOSITE SAMPLE THAT HAS BEEN PRODUCED FROM DRILLING . SUCH A SAMPLE HAS YET TO BE TAKEN .

HOWEVER , HUDBAY CAN WALK AWAY AT ANY TIME . WHILE THE WRITE OFF WOULD BE SIGNIFICANT , SUCH DECISIONS HAVE BEEN MADE MANY TIMES BY MINING COMPANIES AND STILL THEY HAVE GONE ON TO MINE ANOTHER DAY .

THE KEY TO THE SUCCESS FOR THOSE OPPOSING HUDBAY’S ROSEMONT PROJECT RESTS WITH THE GOVERNMENT AGENCIES RESPONSIBLE FOR ISSUING PERMITS . UNFORTUNATELY , THE FOREST SERVICE APPEARS UNABLE AND INCAPABLE TO ADEQUATELY ASSESS THE NEGATIVE IMPACT THAT MINING HAS ON THE ENVIRONMENT . THEY ARE MORE POLITICALLY MOTIVATED THAN TECHNICALLY MOTIVATED .

ARIZONA HAS BEEN REFERRED TO AS THE ” COPPER STATE ” IN THE USA AND THIS CARRIES WITH IT THE TRIALS AND TRIBULATIONS THAT COME WITH MINING COMPANIES WHO ARE ATTRACTED TO THE STATE TO EXPLOIT ITS MINERAL RESOURCES .

WHO OWNS THESE MINERAL RESOURCES AND WHO SHOULD BENEFIT FROM THEIR EXPLOITATION ? AT PRESENT , THE MINING ACT IS A FEDERAL ACT FOR THE BENEFIT OF THE FEDERAL GOVERNMENT . IT IS TIME FOR ARIZONITES TO DRAW UP A STATE MINING ACT FROM WHICH THEY WILL GAIN MAXIMUM BENEFITS .

BASED ON A COMPREHENSIVE MINERAL RESOURCE INVENTORY OF THE STATE , AREAS CAN BE RESERVED FOR EXPLOITATION WHILE OTHER AREAS AREAS ARE EXCLUDED AND SET ASIDE FOR PARKS , WILDLIFE SANCTUARIES , ETC . ARIZONA MUST BE ONE OF THE MOST STUDIED STATES IN THE USA WHEN IT COMES TO MINERAL POTENTIAL . THE DATA BASE GENERATED BY MINING COMPANIES ALONE SHOULD PROVIDE A BASIS FOR ” MINERAL DEVELOPMENT ZONING ” .

LARGE SCALE MINING OPERATIONS AS CURRENTLY BEING CARRIED OUT IN THE STATE ARE BECOMING INCREASINGLY AUTOMATED WHICH MEANS THAT EMPLOYMENT OPPORTUNITIES BECOME LESS AND LESS . THE STATE NEEDS TO LEVY MORE AND MORE TAXES ON THE MINING COMPANIES IN ORDER TO COMPENSATE FOR THE ENVIRONMENTAL DEVASTATION WHICH THEY PRODUCE .

THE TIME HAS COME FOR ARIZONA TO TAKE A LOOK AT WHAT IS CURRENTLY GOING ON IN THE MINING INDUSTRY WITH A VIEW TO WHAT IS COMING IN THE FUTURE . YEARS AGO , MINNESOTA DECIDED TO TAX IRON ORE RESERVES IN THE GROUND IN ORDER TO FORCE MINING COMPANIES TO PRODUCE OR GET OUT . IS ARIZONA PREPARED TO FOLLOW THIS EXAMPLE ? IT WOULD PROBABLY GET RID OF HUDBAY AND MANY OTHERS . THE PRESENT SYSTEM APPEARS TO ALLOW A MINING COMPANY TO SIT ON ITS RESERVES INDEFINITELY EVEN AFTER ALL PERMITTING HAS BEEN APPROVED . THIS IS COUNTER PRODUCTIVE . RULES AND REGULATIONS MUST BE PUT IN PLACE WHEREBY A MINING COMPANY IS HELD TO A TIME FRAME WHICH STIPULATES THAT MINING ACTIVITIES MUST BEGIN BY A CERTAIN DATE ONCE ALL PERMITTING HAS BEEN COMPLETED .

Alan you sound like you are resident of Arizona … I am Canadian and a shareholder of Hudbay.

I work in the Auto industry and our goal is to automate and build multiple platforms with the same capital. I do not know what economic benefit accrue to the residents of the state. But I agree if there is no ongoing employment benefit to the state and no ongoing royalty it would make sense to leave the copper in the ground.

But have you considered that most international companies do pay state and federal taxes that help support various levels of government. Hudbay is a medium size mining company that has managed to survive in a very volatile environmental by knowing as you have said to develop or not develop a potential mining site.

I am watching with interest…. But they do have Peru possibilities that will fill there need for a mine to add to their portfolio over the next three to five years…

All parties must be aligned to make these type of investment worth while…

I have not ever visited the state but look forward to be golfing there soon…

Good luck with your investments…