Hudbay Minerals stock was pummeled Thursday to its lowest level in six years following the company’s announcement of an unexpected $55.2 million second-quarter loss, according to its 2nd Quarter Financial Statement.

Wall Street analysts were projecting Hudbay, the owner of the proposed Rosemont Mine, would post a $.14/share profit for the quarter ending June 30, but instead, the company finished with a ($.24/share) loss.

On Thursday, Hudbay’s stock lost 7.94% percent on the New York Stock Exchange, falling 52 points to close at $6.03 in heavy trading at 230,000 shares. The stock traded as low as $5.82 before recovering in late trading.

Hudbay’s stock has rebounded some, closing Monday at $6.27.

Hudbay’s Management Discussion & Analysis report states the company spent $13.8 million in the second quarter on the proposed Rosemont Mine bringing the total for the first six months of 2015 to $24.8 million.

Hudbay has $328.4 million in capital spending commitments if, and when, Rosemont construction begins, $192.1 million of which cannot be terminated. The proposed mine is located in the Santa Rita Mountains on the Coronado National Forest 35 miles southeast of Tucson.

Hudbay must still obtain an Air Quality Control Permit from the state of Arizona, a Clean Water Act Section 404 permit from the U.S. Army Corps of Engineers, which can be vetoed by the U.S. Environmental Protection Agency, and the final Record of Decision from the U.S. Forest Service before construction on the $1.5 billion Rosemont project could proceed.

The EPA has recommended that the Army Corps reject the 404 permit based on a 2013 plan submitted by Rosemont’s previous owner, Augusta Resource Corp.

Hudbay’s board of directors has not yet approved Rosemont construction. Hudbay acquired the mine site in 2014 when it purchased Augusta in a $500 million stock deal.

Copper prices have fallen sharply this year as Chinese demand has dropped. China consumes about 45 percent of the world’s copper. Copper was trading at about $2.37 a pound on the London Metal Exchange on Thursday.

Hudbay CEO David Garofalo told analysts on a Thursday morning conference call that he believes the “equilibrium price” for copper is between $2.60 and $2.80 a pound.

“Our view is that a $3 copper price is a couple of years away,” he said.

The company reported its cash cost for producing copper after sales of by-products including gold and silver fell to $1.29 per pound, down 37 percent from $2.04 per pound for the same period in 2014.

Hudbay said it has received approval from its lenders to increase its line of credit from $300 million to $400 million. This is the second time this year that Hudbay has increased its line of credit by $100 million.

“Hudbay expects to achieve the full year 2015 production and operating cost guidance for all of its operations,” the company said in a news release.

Hudbay’s second quarter loss stemmed primarily from a $21.1 million pension expense related to a new collective bargaining agreement with six of its seven unions and a $24.6 million “impairment charge” resulting from a decision to scrap a concentrator at its Lalor Mine in Manitoba.

Hudbay reported a sharp increase in production in the second quarter compared to the same period in 2014 as its Constancia open pit copper mine in Peru reached commercial production. Copper, gold, silver and zinc production increased by 270%, 37%, 301% and 9%.

Revenue increased to $185.8 million in the second quarter, up from $139 million for the same period in 2014.

The company, however, reported having more than 73,000 tonnes of unsold copper concentrate containing 19,200 tons of copper, 30,300 ounces of gold and 579,300 ounces of silver. Garofalo said that approximately two-thirds to three-quarters of the unsold concentrate is in Peru.

This is the second quarter this year that Hudbay Minerals has reported unsold copper concentrate. Garofalo said the company had 6,000 tonnes of unsold copper concentrate and 9,000 ounces of gold at the end of the first quarter, according to a transcript of the company’s May 8 conference call with analysts.

“Operating cash flow, while 76% percent higher (year to year), would have been multiples higher if not for the substantial amounts of metal still unsold at the end of Q2,” the company states in a second quarter earnings presentation.

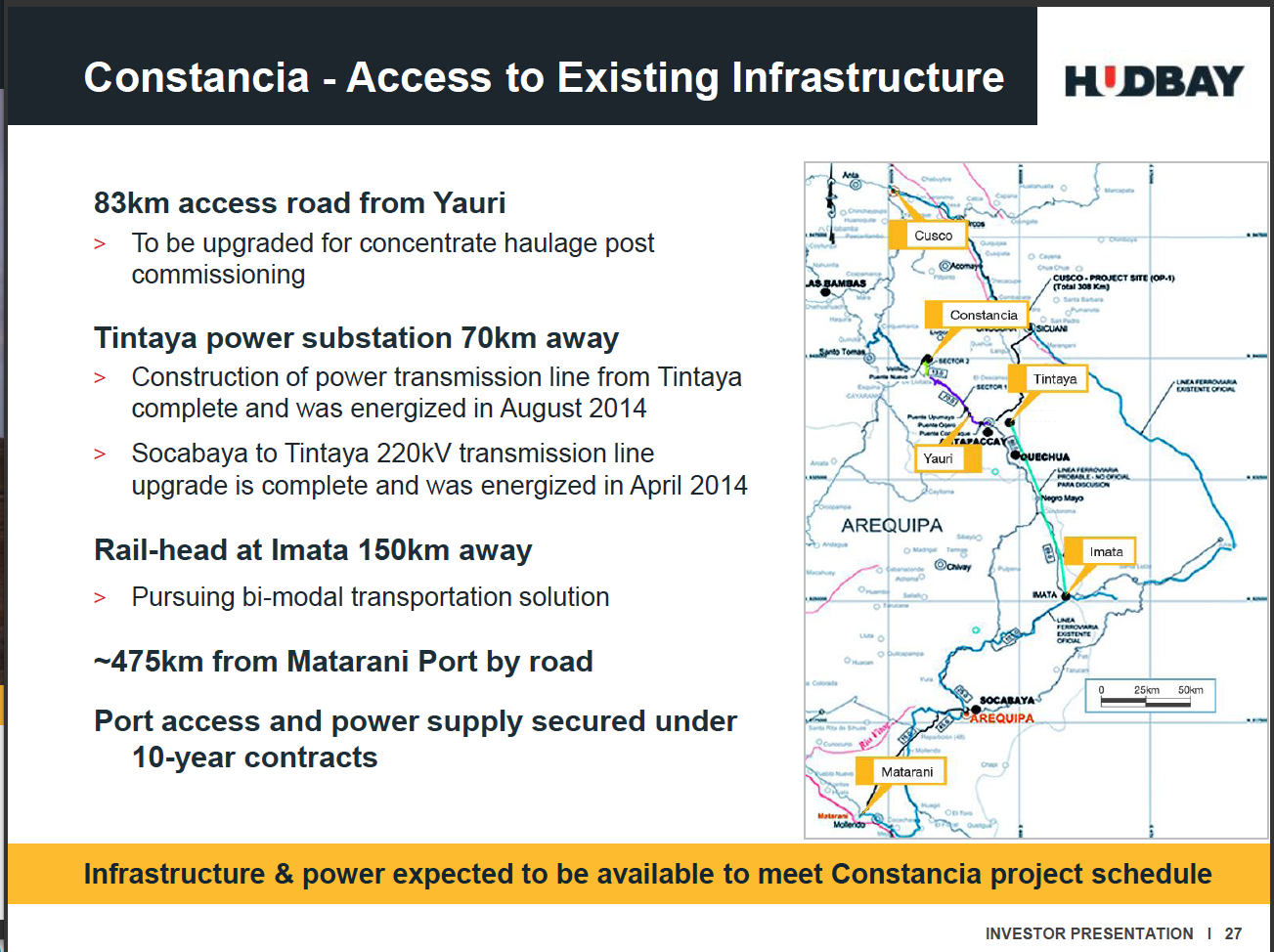

Social upheaval in Peru is hampering Hudbay’s ability to move copper concentrate to the seaport 475 kilometers away in Matarani, company officials said. Hudbay is now budgeting that it will take each truck three days instead of two days to complete the round trip from the remote Constancia mine site high in the Andes to the port, Hudbay Senior Vice President Alan Hair said.

Click to Enlarge: Detailed map of Hudbay’s Constancia mine showing location of key infrastructure. Source: Hudbay Investor Presentation, Oct 2, 2014.

Hair said the company was “confident” it would be able to ship the unsold copper concentrate by the end of the year. The company stated the unsold inventory along with a pending tax refund from the Peruvian government is worth $100 million and should be realized before the end of the year.

Road blockades related to violent protests over the construction of the proposed Tia Maria copper mine and an irrigation dam project have delayed shipments, company officials said. Road construction on the narrow, dangerous road used by Hudbay’s trucks is also causing long delays, the company said.

The widespread protests could severely impact future mining investment in Peru.

The upheaval could reduce mining investment to “very close to zero” by 2018, down from a record $9.7 billion in 2013, unless the government defends new projects, Carlos Galvez, president of Peru’s National Society of Mining, Petroleum and Energy, told Bloomberg News in May.

Hudbay’s Constancia mine site was occupied by protestors last November for ten days. Local communities are alleging that Hudbay has failed to deliver on promises made in an agreement that gave the company access to land for the Constancia open pit.

ALL OF THE METAL MARKETS ARE IN TURMOIL . TAKE A LOOK AT CLIFF RESOURCES AS AN EXAMPLE . THE WORLD’S ECONOMY IS ESSENTIALLY IN RECESSION . HUDBAY IS RIDING OUT THE STORM WITH COST CUTTING MEASURES BUT WITHOUT MINE CLOSURES , SO FAR .

HUDBAY IS IN NO RUSH TO MOVE AHEAD WITH THE ROSEMONT PROJECT AT THIS TIME AND WILL SIT ON THE PROPERTY INDEFINITELY , IF REQUIRED . THE FOREST SERVICE , BY SLOWING DOWN THE PERMITTING PROCESS , IS DOING HUDBAY A FAVOUR .

THE DECLINE IN THE CANADIAN DOLLAR IS A MAJOR CONCERN TO HUDBAY AS IT DILUTES THEIR CASH RESERVES THAT ARE DENOMINATED IN DOLLARS .

HUDBAY IS IN FOR THE LONG HAUL WITH ALL EYES FOCUSED ON CANADA’S FEDERAL ELECTION TO TAKE PLACE ON OCTOBER 19 , 2015 . WHAT IF THE NDP SHOULD WIN ?

PLEASE NOTE CORRECTION : CIFF RESOURCES SHOULD READ ” CLIFFS NATURAL RESOURCES ” . THIS COMPANY IS ONE OF THE LEADING US IRON ORE PRODUCERS THAT HAS FALLEN ON HARD TIMES .

IT IS STATED THAT HUDBAY SPENT $24.8 MILLION ON THE PROPOSED ROSEMONT MINE DURING THE FIRST 6 MONTHS OF 2015 , HOWEVER , THERE IS NO INDICATION THAT THIS MONEY WAS SPENT ON THE GROUND . HOW WAS THIS MONEY SPENT ?

Good Golly Hudbay Stock Will Double After US Pres Barack Obama Gets Out Of Office!! The World And The USA Need Copper MInes!! Remember The Name “Donald J. Trump” The Next POTUS \. God Bless America.