HudBay Mineral Resources today said Augusta Resource Corporation has failed to address “critical permitting and financing risks that cast doubt on Augusta’s plans to develop the Rosemont project.”

HudBay issued the statement in response to Augusta’s issuance of a Director’s Circular earlier this week in which Augusta provided reasons why its shareholders should reject HudBay’s $540 million, all stock, hostile takeover bid.

HudBay said Augusta has disclosed no information in the Director’s Circular that “warrant modification by HudBay of its initial offer” to acquire all of Augusta’s 145 million outstanding shares of common stock that it doesn’t already control.

Toronto-based HudBay owns 23 million shares of Augusta purchased over the last four years. HudBay is offering about $2.90 a share for Augusta’s stock.

HudBay was sharply critical of Augusta’s weak financial condition and suggested that Augusta’s outlook is increasingly bleak as a $109 million debt to RK Mine Finance comes due in July. Augusta has pledged all the assets of its Rosemont Copper Co. subsidiary as collateral for the RK loan.

HudBay president and chief executive officer David Garofalo was quoted as saying,

“[w]e have serious concerns about Augusta’s working capital deficiency of US$87 million as at September 30, 2013, and its capacity to secure financing except on terms that will significantly dilute its shareholders or otherwise impair shareholder value.”

HudBay also strongly suggested that Augusta was not being completely forthcoming with its shareholders in its Director’s Circular.

“The failure of Augusta to address these fundamental issues in their circular should give all Augusta shareholders pause,” Garofalo said.

HudBay pointed out that Augusta has missed at least 10 projected dates when the company stated the permitting process for its Rosemont copper project would be complete and that the company is now four years beyond its original projection.

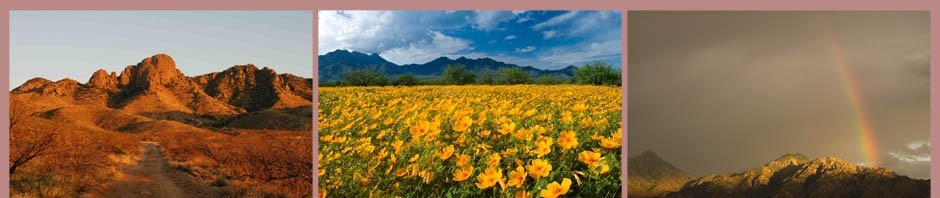

HudBay stated that Augusta’s assurances that construction on the mile-wide, half-mile deep mine on the northeastern flank of the Santa Rita Mountains on the Coronado National Forest will begin in 2014 are not supported by the facts including:

- Although the regulatory process requires review of comments on the draft record of decision (“ROD”) within the 45-75 day period referred to by Augusta, there is no requirement that the final ROD be issued at the end of that period and, as publicly acknowledged by the U.S. Forest Service in December 2013, there is a possibility that additional studies or mitigation will be required. The final ROD and Clean Water Act 404 permit will not be issued until all matters are resolved.

- Augusta’s new final environmental impact statement (FEIS) is based on a revised mine layout, which will require some of the previously granted key permits to be amended. The amendment process may include a requirement for additional public consultation which would then reopen the administrative appeal process.

- Two of the seven key permits Augusta has received are currently subject to legal challenges, which are unlikely to be resolved in 2014.

“Based on this permitting uncertainty, it is unclear how Rosemont could be fully financed by mid-2014, as asserted in the Augusta Circular,” HudBay stated.

Augusta critics have long pointed out the company’s weak financial condition and its pattern of misleading statements.

One Response to HudBay charges Augusta is ignoring “critical permitting and financing risks”