Copper “concentrate” is a sandy mix containing copper and other materials that is typically sent to smelters and refineries to be converted into a usable metal called copper cathode. Copper cathode is at least 95% pure copper and can be used to make copper rods and plates.

Hudbay will have to export all copper concentrate because there’s a lack of U.S. smelting and refining capacity. The U.S. already exports about 25% of the copper concentrate domestic mines produce each year, according to the U.S. Geological Survey. Hudbay has no plans to construct a smelter, which would face intense environmental opposition because of their high emissions.

Hudbay’s latest technical report raises significant questions about whether the company will ever produce finished copper on-site, given the high costs of constructing the equipment needed to convert copper concentrate into finished copper without using a smelter.

Hudbay states in the regulatory filing it plans to invest $367 million in a “concentrate leaching” facility during the fourth year of operations that will allow it to convert copper concentrate into finished copper cathode on-site from a mix of oxide and sulfide copper ore without a smelter.

At the same time, Hudbay also states it expects strong demand for Copper World’s copper concentrate as worldwide smelters and refiners try to keep up with the projected high demand for finished copper from the growing worldwide renewable energy industry.

“Global markets are expected to compete aggressively for concentrate supply, providing a keen market for offshore sales of Copper World concentrate,” Hudbay states.

If Hudbay builds the concentrate leach facility during the fourth year of production, which remains uncertain, it projects that 58% of the concentrate produced at Copper World will be converted to the finished copper cathode on-site, with the rest of the copper concentrate exported to overseas smelters.

Hudbay executives have been quietly telling investment analysts since August 2022 that it may not build the concentrate leaching facility and instead export copper concentrate overseas, which was the original plan for the Rosemont pit since Hudbay purchased the mining site in 2014 from Augusta Resource Corporation.

Hudbay’s plans for the Rosemont pit on the northeast side of the Santa Rita Mountains were upended in 2019 when a Tucson federal judge ruled that the U.S. Forest Service illegally approved the company’s mine plan that included dumping waste rock and tailings on 2,477 acres of Coronado National Forest. A federal appeals court upheld the ruling in May 2022. Hudbay then shifted its focus to developing a series of much smaller open pit mines on the west side of the Santa Rita Mountains and purchasing adjacent private land to dump mining waste.

In June 2022, Hudbay released a technical report called a Preliminary Economic Analysis that described a two-phase, 44-year mining plan that was designed to produce copper cathode on-site to be sold entirely in the U.S. market. That plan required a $1.9 billion initial capital investment and included the concentrate leaching facility at the beginning of the project.

This month’s feasibility study significantly revises the previous mining plan by reducing the initial capital investment to $1.3 billion, delaying construction of the concentrate leaching facility, and shortening the life of the mining complex to 20 years.

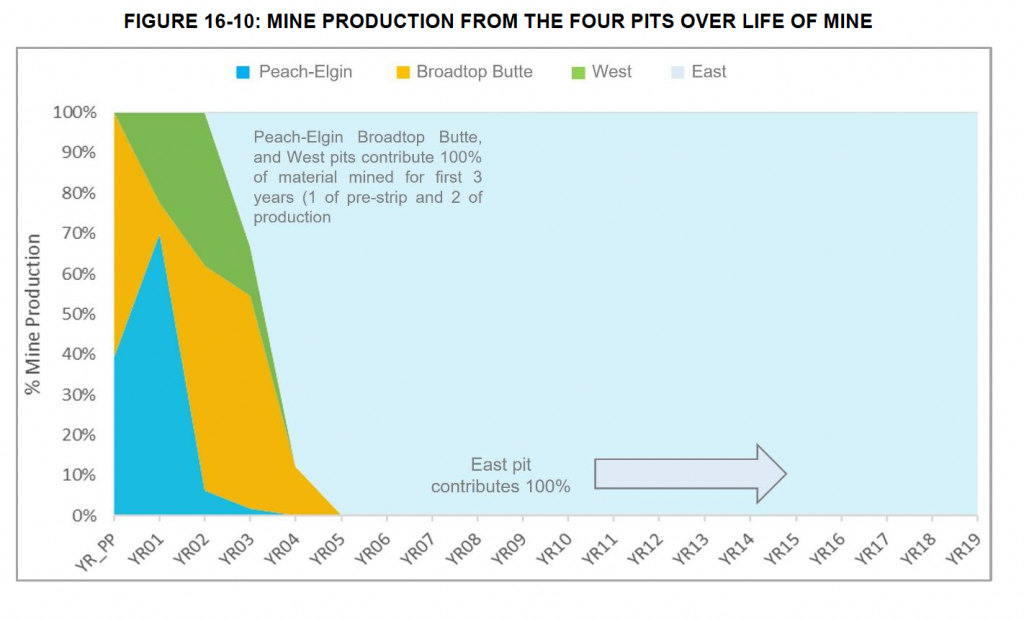

Hudbay now states that nearly all the production will come from three relatively shallow open pits on the west side of the Santa Rita Mountains in the first three years before shifting to the primary Rosemont pit, which the company now calls the East pit, that will produce 74% of the copper from the complex during the last 17 years of production.

The Peach-Elgin, Broadtop Butte, and West pits on the mountain’s west side will each average about 5,600 feet in diameter with an average depth of 520 feet, according to the technical report. The final Rosemont pit will be about 8,200 feet in diameter and have a depth of approximately 2,250 feet.

The company states it has sufficient space on private lands on the mountain’s west side to dump 856 million tons of waste rock and 440 million tons of mine tailings for 20 years of production. Hudbay is seeking to purchase at least 160 acres of State Trust Land managed by the Arizona State Land Department through a public auction to dump additional mine tailings that would allow it to increase copper production from low grade ore.

The department has not set an auction date, and there is widespread opposition to the mine and auctioning State Trust Land to the Canadian company.

No difference at the Hermosa Mine in the Patagonia Mountains. Why give away AZ resources to have foreign nations make all the money abroad? AZ today is a semiconductor power house where billions of dollars are invested every year to add more value with a gallon of water than any other commodity industry while creating tens of thousands of jobs, not a few hundred. Critical minerals can be found anywhere where there is less damage done to public health and environment while demand always disappears because of less critical alternatives, like replacing manganese based EV batteries with lithium iron phosphate ones. Damage due to such opportunistic endeavors is the price to be paid when lobbyists run the government and dictate local supervisors.

IT IS TIME FOR THE US AUTHORITIES TO STEP IN AND DECLARE COPPER A STRATEGIC METAL WHEREBY ALL COPPER CONCENTRATES FROM THROUGHOUT THE USA CAN NOT BE EXPORTED FOR SALE TO TO THIRD PARTIES FOR REFINING AND PROCESSING . HUDBAY CAN BUILD AN ELECTROLYTIC FACILITY TO TREAT THEIR CONCENTRATE AND THEREBY PRODUCE SEMI REFINED COPPER METAL . A SIMILAR PROCESS WAS USED BY NORANDA’S GASPE MINE IN CANADA . HUDBAY IS LOOKING FOR THE WAY THAT SUITES THEM BEST . CONCENTRATES ARE SOLD FOR CASH RETURNS AND NO FURTHER INVESTMENT COSTS . IF THE US IS SERIOUS ABOUT ITS STRATEGIC METALS INVENTORY , THEY MUST BUILD IT FROM WITHIN THE COUNTRY .